Thanet Property Market: Why Cash Buyers Aren’t Saving the Day Despite Soaring Interest Rates and Predictions!

The UK Property Market Shifts

The UK property market has undergone significant shifts since the summer of 2020, driven primarily by the post-lockdown race between the summer of 2020 and late 2021, and then a rapid series of interest rate hikes aimed at curbing inflation in 2022 and 2023. These changes have had far-reaching implications across the property market, influencing both prices and transaction volumes.

As we explore the nuances of these changes, it becomes evident that while some anticipated a property market crash, particularly due to Covid and the interest rate hikes, this did not fully materialise. The market has shown resilience under pressure.

Interest Rates and Their Impact on Thanet

The initial wave of interest rate hikes began in November 2021, as the Bank of England sought to counter rising inflation. Over the period, interest rates rose 14 times, peaking at 5.25%. These increases, aimed at controlling the escalating cost of living, have left a lasting mark on the market. However, a slight rate cut in August 2024 to 5%, alongside improved inflation figures, has brought cautious optimism to the property market.

Local Property Market Prices

Looking at house prices in Thanet over the last four years, we see that the average value of a property in Thanet in July 2020 was £241,940. Today, it stands at £286,705, a rise of 18.5%. This suggests that cash buyers may have played a role in sustaining the market, despite higher interest rates.

The Role of Cash Buyers: Surprising Findings

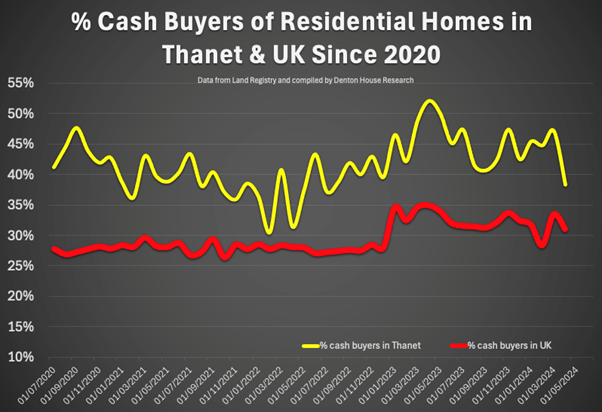

Traditionally, cash buyers are perceived as having a significant advantage in a high-interest-rate environment. Yet, the data suggests that cash buyers, while increasing in proportion, did not dramatically alter the market. In 2023, 45.6% of buyers in Thanet were cash buyers, yet their influence was more muted than expected.

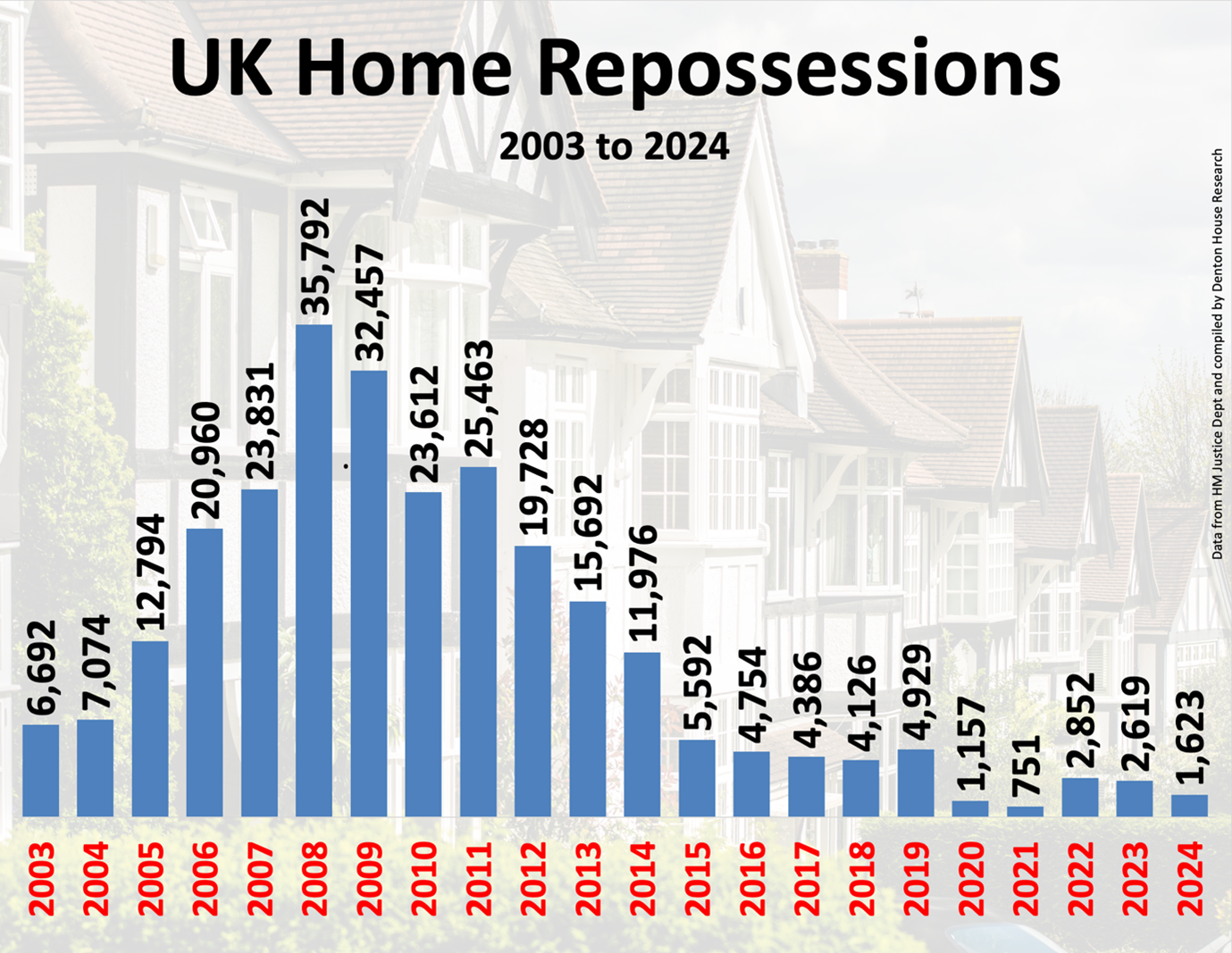

Mortgage Stress-Testing: A Factor in Stability

The Mortgage Market Review's stress-testing rules introduced in 2014 have been instrumental in maintaining stability. Designed to ensure borrowers could withstand higher interest rates, these measures helped protect the market from the predicted collapse. Coupled with strong wage growth and lender forbearance, they helped prevent widespread distress.

Affordability and Buyer Preferences

Affordability continues to be a key concern for buyers, especially in expensive urban markets. The 'race for space' trend has driven many buyers out of cities to suburban or rural locations. In Thanet, where space and affordability remain attractive, these trends have helped sustain demand.

Sales Volumes and Prices

While sales volumes decreased in 2023, prices remained robust. Transactions peaked at 1.4 million in 2021 but fell to 1.02 million by 2023. Yet, 2024 projections indicate a recovery, with approximately 1.15 million transactions expected, reflecting a stable and resilient market.

Looking Ahead: The Future for Thanet

The UK property market appears to be at a pivotal moment. As we progress through 2024, we see signs of renewed confidence. With listings up, gross sales higher, and a 2.6% rise in sale prices per square foot, the market is poised for a potential recovery. Further rate cuts could bolster this trend.

Please Click Here to visit our blog, property insights, and more.

We welcome your comments or suggestions for future articles.

About Cooke & Co

Cooke & Co has been providing estate agency services in Thanet since 1992, covering Margate, Broadstairs, Ramsgate, and surrounding areas.

Contact us:

- Margate Office: (01843) 231833

- Ramsgate Office: (01843) 851322

- Broadstairs Office: (01843) 600911

No comments

Leave a comment