Tag : interest

Show All

Thanet Property Market Review: The November 2024 Update

Discover the latest trends in Thanet's property market for November 2024, with insights on average home prices in Margate, Broadstairs, and Ramsgate. Cooke & Co’s property market review provides valuable information to guide your decisions, whether you’re buying, selling, or simply interested in local property values.

13/11/2024

4198

Thanet's Unprecedented £5.08 Billion Legacy: Navigating Through The Generational Wealth Maze

As spring 2024 unfolds, Thanet faces a £5.08 billion Baby Boomer inheritance. But with Gen X and Millennials at the crossroads, can this windfall address their housing and retirement dreams amidst rising healthcare costs?

04/04/2024

5309

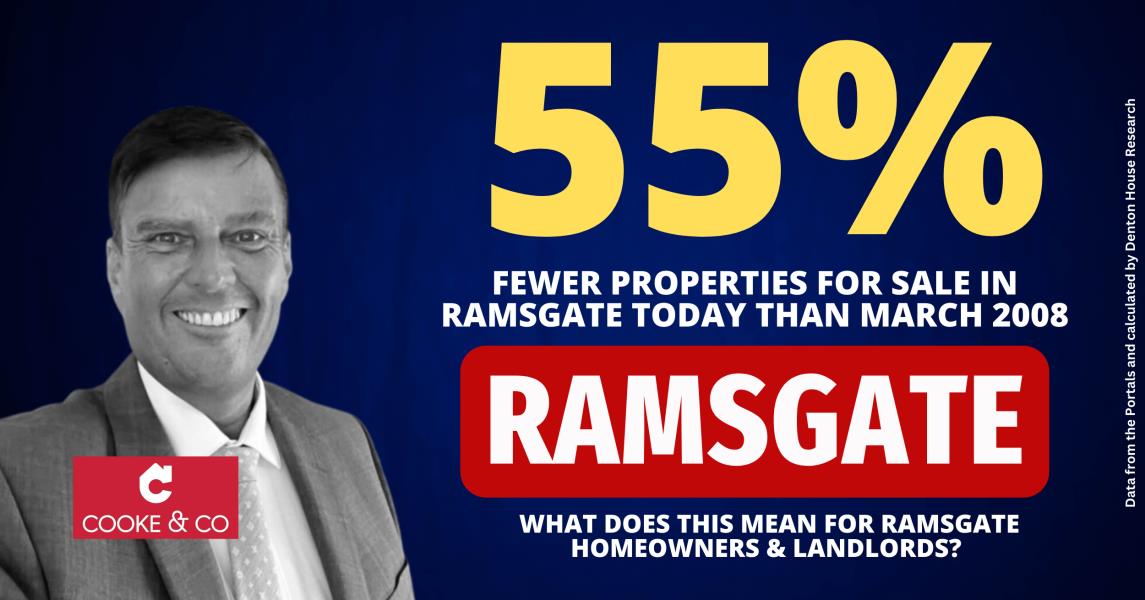

Shocking Thanet Property Shifts You Won't Believe!

Discover how Thanet's property market has dramatically transformed since 2008. Margate, Broadstairs, Ramsgate - the changes are astounding. Dive in for a quick, eye-opening read!

11/03/2024

5355

Thanet's Mortgage Rate Drop: A Beacon Of Opportunity In 2024'S Housing Market

Discover how Thanet's unexpected mortgage rate decrease is reshaping the local housing scene, offering a silver lining for homeowners, landlords, and first-time buyers alike. This blog examines the impact of these financial shifts, revealing the potential for savings, increased affordability, and revitalized market activity in the vibrant coastal communities of Margate, Broadstairs, and Ramsgate.

26/02/2024

4708

STOP PRESS! Rising Mortgage Rates: Impact On Thanet Homeowners

Today’s increase in Bank of England rates has sent ripples of concern among Thanet homeowners, particularly those with impending remortgages or seeking new deals. The decision by the Bank to raise rates by 0.5% has sparked discussions about the potential consequences and the steps Thanet homeowners should consider taking.

22/06/2023

4988

Impact Of Base Rate Increases On The UK Property Market.

As a property agent with over 30 years of experience, I believe that the consecutive increases in the base rate can be attributed to several factors, including the Bank of England's response to inflationary pressures and the use of quantitative easing. Let's find out more in my article.

11/05/2023

5358

Mortgage Overpayments , How To Increase The Equity In Your Thanet Home

Mortgages are dull. Let’s be honest. They’re huge commitments, they’re complicated to arrange and in the current climate, it’s understandable if the thought of a mortgage gets you a bit jittery.

Putting rising interest rates to one side (easier said than done) and ignoring the doom and gloom news we’ve been exposed to over the last few months, it’s time to talk about mortgage overpayments.

What are they? Are they a good or bad thing?

In this four-minute read, we explain the ins and outs of overpayments.

18/12/2022

5409

Mortgage Update: What Homeowners And Buyers In Thanet Need To Know

Here are five tips to help mortgage hunters find the best deal in the current market.

With inflation and interest rates rising and so much uncertainty in the market, choosing the right mortgage deal in the current climate can be daunting.

While no one has a crystal ball to predict exactly what will happen over the next 12 months, Cooke & Co’s financial advisers suggests you follow these five common-sense rules* when looking for a mortgage.

15/12/2022

4156

Will The Cost-Of-Living Crisis Mark The End Of The Booming Thanet Property Market?

Thanet property prices have increased by 27.8% over the last two years.

Thanet house prices have risen on the back of several things, including changes in how people see their homes and how they live and work (i.e. working from home), a lack of properties on the market and government tax incentives (the stamp duty holiday in 2020).

Yet, the tide could be beginning to turn as the number of houses coming on the market is increasing as supply is starting to catch up with demand - in Q1 2022, 389,811 properties came onto the market in the UK compared to 425,295 in Q2 2022. One would typically expect Q1 to be larger than Q2 in average years.

Yet some commentators are saying one thing that could stifle this growth is the cost-of-living crisis.

03/08/2022

6469

The 6 Reasons Thanet Rental Properties Could Inflation Proof Your Savings?

• Inflation (and recessions) can be nerve racking for people and their hard-earned savings and wealth.

• Yet there are six reasons which make investing in private rental properties a potentially wise investment in these changeable times.

• This article looks at how investing in Thanet property could help you 'hedge' against inflation and protect your savings and wealth against the possible recession.

31/05/2022

5034

Search

Categories

#Fairytaleday1

#Fathersday1

#Internet1

#Landlord2

#Letting2

#Price Per Square Foot1

#Tenants1

10Years2

12Months1

17Thfeb1

1952Tonow1

202137

2022149

202363

2023 Tips1

2023]1

202429

2024 New Year1

20253

20281

20501

21Stjune1

2Nddecember1

30Years3

3Tips1

4Beds1

5 Years1

5Reason1

5Thnovember1

Accidental1

Accidents1

Accountable1

Accounting1

Accounts1

Addiction1

Addspace1

Advice261

Advicetips1

Affordable1

Ai2

Airbnb2

Alarm1

All Areas1

Amazing Apartment1

Angelia Raynor MP1

Announcement2

Antibullingweek1

April1

April20241

Aprilfool5

Archetecture1

Aricle1

Arla11

Art1

Artice1

Article4

Articles1

Assistamce0

Assistance1

August2

Autumn5

Average1

Avoid1

Awardwinners1

Awardwinningagents1

Babybank1

Babyboomers1

Backtoschool1

Bargain1

Bathroom1

Batterprice1

Beaches1

Bedroom1

Beinbeforexmas1

Beinsured0

Bekind1

Benice1

Benk1

Beprepared2

Berealistic1

Best Home1

Bestadvice1

Bestpractice1

Bestpractive1

Bettertenants1

Bigchange1

Bitcoin2

Blog5

Bonfirenight1

Bookavaluation1

Breakingnews3

Brexit2

Broadstairs21

Broker1

Btl8

Budget2

Budget20242

Bugs1

Builder1

Builders3

Building5

Building Insurance1

Buildings1

Buildingsurvey1

Bully1

Bungalow2

Bungalows1

Buttolet1

Buy1

Buyer15

Buyers3

Buyersremorse0

Buyi1

Buyin20241

Buyinbg1

Buying88

Buytolet28

Camping1

Canwehelp1

Carbonreduction1

Care1

Carehome1

Cash1

Celebrate1

Celebration3

Census1

Chain2

Chainfree1

Change2

Changeagent1

Charity4

Cheapbuying1

Checklist2

Cheerup1

Chemicalfree1

Children4

Chocholic1

Chooseanestateagent1

Choosetherightagent1

Christmas15

Cleaning4

Clientmopneyprotection1

Closetosesa1

Comment1

Commentary2

Commentry4

Commitments1

Commnetry1

Commuinity1

Community34

Compromise1

Con1

Condensation1

Conflict1

Consideration1

Contents1

Conveyancing1

Cookeandco1

Coronation1

Costof Living1

Costofliving6

Costs2

Council1

Councilowned1

Couple1

Cover1

Covid 194

Crash2

Crime3

Crisis3

Crooks1

Customer Service1

Customers19

Customerservice4

Damiencooke1

Damp1

Daylight1

Debt1

December1

December20231

Declutter1

Decorating2

Decore1

Deposit2

Deposits1

Design1

Det1

Detail1

Detailed1

Developers4

Digital1

Digitaldeclutter1

Dioy1

Disaster1

Disaters1

Distress1

Divorce4

Diy13

Documents1

Doglover1

Dogs3

Donsizing1

Dontdoit1

Dontmissout1

Doomandgloom1

Downsize1

Downvalue1

Dreamhome1

Easter1

Easterarticle1

Eat2

Education1

Elecric1

Election1

Emergency1

Emertgency1

Empty1

Emptyhomes1

Energey Efficiency1

Energy9

Energyperfomancecertificate2

England1

Enigma1

Enjoy2

Entertainment1

Epc6

Estateagencythanet1

Estateagent2

Estateagents1

Ethical1

Eu1

Eurovision1

Eviction2

Ex[Perts0

Exciting5

Expereience1

Experience5

Experts14

Explainations1

Explore1

Fa1

Facts5

Fallthrough2

Families2

Family2

Faq1

Fashion2

Fastest1

February1

Feelgood1

Feeling1

Feelingstuck0

Fengshui1

Figures10

Fillyourproperty1

Film1

Films1

Finacial Services1

Finanace1

Finance1

Finances3

Financialservices12

Firemworks1

First1

First Time Buyer1

Firstbuy1

Firsthome1

Firsttime2

Firsttimebuyer4

Fivestar1

Fivestars1

Fivestarservice2

Flat1

Fleas1

Flowers1

Flythrough1

Follow The Sun1

Foocbank1

Football4

Forsale10

Fourbeds1

Fraud1

Fraudprevention1

Free3

Free Advice0

Freehold1

Freelisting1

Fresh Approach0

Freshstart1

Friendly1

Friends1

Fs2

Ftb6

Fuin1

Fullsurvey1

Fun83

Funfact1

Furnished1

Furnishing1

Future6

Gadgets2

Garageconversion1

Garden5

Gardening2

Gardens2

General26

Generationrent1

Getmoving1

Gettingbestdeal1

Gifts2

Giverment1

Givernment1

Glastonbury1

Globalwarming1

Gogreen1

Golf1

Goodagent3

Goodidea1

Goodluck1

Goodnews2

Goodpractice1

Goodtimes1

Goodtimetosell1

Goodwill1

Google1

Govenment1

Governement1

Government3

Granddesign1

Graph3

Great Stats1

Green3

Greenpolicies1

Grief1

Groundfloor1

Guide1

Hacks2

Happy Christmas1

Happy New Year1

Happychristmas1

Happyeaster1

Happyfathersday0

Happynewyear3

Happypets1

Healthy1

Healthyeating1

Heat1

Heating1

Heatmap1

Heatwave1

Helo0

Help33

Helpftb1

Helpful1

Helpfuladvice1

Helptobuy3

Helptosell1

Heros1

Highervalueproperties1

Hints7

History1

Hmrc1

Hobbies2

Hobby1

Hoints0

Holiday2

Holidays1

Home7

Home Automation1

Homebuyer1

Homegoldmine1

Homehelp1

Homeimprovement6

Homeowner1

Homeowners2

Homeownership1

Homes1

Homeselling1

Homesunderthehammer1

Hometoobig1

Honest1

Honesty1

Hotbuy1

House6

House Price4

Houseblockers1

Househunt1

Housemarket15

Houseplants1

Houseprice2

Houseprices12

Houses1

Housing3

Housingassociation1

Housingshortage1

Howlonginhome1

Icerink1

Ideas6

Iideas1

Iinteriordesign1

Illegal2

Important1

Improved1

Improvements1

Increase3

Indepth2

Ineterst0

Inflation9

Info2

Information2

Informed1

Insight4

Insights1

Inspections1

Inspiration1

Insulation1

Insurance2

Integrity1

Interest3

Interesting2

Interestrate0

Interestrates4

Interference1

International1

Intheknow1

Investment21

Investor2

Investors1

Jan241

January5

Jargon1

Jobs1

Joint1

Jointlet1

Joke1

Journey1

July1

Jumpers1

June20241

Kent3

Kids2

Kindness2

Kitchen1

Knowledge1

Labour2

Landandnewhomes1

Landlord135

Landlord Tips1

Landlordadvic1

Landlords11

Landlords Advice Fun1

Landregistry1

Landregisty1

Lanlordss1

Lattings0

Law2

Leadingagents1

Leapyear1

Leasehold1

Legal3

Legal Advice For Landlords1

Legal Changes1

Legislation25

Legistlation1

Legla1

Letting32

Lettingagent1

Lettingagents1

Lettings9

Lifestyle1

Lift1

Limited1

Links1

Local7

Locate Homes1

Location1

Londonmarathon1

Lonely1

Lookingtobuy1

Lookingtosell1

Losemoney1

Love3

Lovethem1

Lovetohelp1

Luxury2

Maintainance6

Maintaince1

Manaagement1

Management24

Managing1

Managment1

Map1

March 20241

March20241

Margate23

Margateprices1

Margatesales1

Market17

Market Update1

Marketcommentry13

Marketing3

Maths1

Maximise1

May2

May20242

Mental Health1

Mentalhealth5

Mentalwellbing1

Metime1

Mistake1

Modern1

Mogtheringsunday1

Money5

Moneyraised1

Moneysaving1

Mood1

Mortgage6

Mortgages10

Mortgate2

Motherday1

Movenow1

Moving6

Moving In Together1

Movinghome1

Movingin2

Movingintogether1

Movingout1

Movingtips13

Mumanddad2

Mumsmoving1

Music1

Myths1

Naea3

Needsreferbishment1

Negatives1

Negotiation1

New1

New Act1

New Builds4

Newbuild1

Newhome2

Newlaws1

Newnormal2

News3

Newsflash2

Newstart1

Newyearresolutions1

Niovember1

Nocrash1

Nofireworkfun1

Noreductions1

Nosection211

Nosignstopping1

November3

November 20242

Number11

Numberone2

Oap1

Oct242

October9

October 1St1

OEA1

Older2

On Bedroom1

Ontherise1

Organise1

Oroperty1

Ourview1

Outside1

Overprice2

Overpriced1

Overvalue1

Parents1

Partents1

Pastimes1

Payfirst1

Payupfront1

People1

Perfectsteps1

Personalview1

Pests1

Petfriendly1

Pets2

Photos2

Planning1

Plantsnottohave1

Plastic2

Plumbing1

Police1

Politicalcomment1

Politics1

Pop1

Poppies1

Poppy1

Popular1

Portals1

Positive3

Positivestart1

Postiveread1

Ppsqft1

Predictions2

Preditctions1

Preventative1

Prevention1

Price4

Prices5

Pricesurge1

Pricing1

Priopertyprices0

Private1

Pro Tips1

Problem1

Problems2

Process3

Productivity1

Proeprtymarket1

Proffessional2

Proffessionals1

Profit5

Proiperty1

Property16

Propertyanalysis1

Propertyasanivestment1

Propertyexpert1

Propertyexperts2

Propertyfacts1

Propertymanagement1

Propertymarket10

Propertyprices3

Propertystats1

Propertytrends3

Pulse1

Purchase2

Purchaser3

Queries1

Quick Read2

Quickest1

Quickread3

Quicktips1

Quiz1

Ramsgate31

Rates2

Reading1

Ready1

Realisiticprice1

Recipe1

Recommendations2

Redtape1

Reduction2

Reductions1

Referbish2

Reform2

Relationships1

Relax2

Reliaable1

Relocation2

Rememberance1

Remorse1

Remortgage2

Rent1

Rental11

Rental Advice1

Rental Lettings1

Rentalmarket1

Rentalmarketinsights1

Rented5

Renters Reform1

Rentincrease1

Renting15

Rentprotection1

Rents12

Rentstohigh1

Repairs13

Report1

Reservations1

Reslistic1

Respect1

Resposibilities1

Rightagent1

Rise In Prices1

Risingprices1

Robots1

Rollon20231

Rubbish2

Sacrifice1

Sad1

Safetly1

Safety4

Sales7

Santa1

Saturday1

Save4

Savemoney1

Saving1

Saynotobulling1

Scam1

Scams2

Schemes1

School2

Schools1

Schoolsout1

Searches2

Seaside2

Season1

Seaview1

Secondhome1

Secrets6

Security1

Seeling1

Selfbuild1

Sell2

Seller29

Seller Statistics1

Sellers1

Selling142

Sellingwithpets1

Sellnow2

Semi1

Senses1

Service4

Setrent1

Settingthescene1

Sevenquestions1

Sharing1

Shocking1

Shopping1

Short8

Short Read1

Short]0

Shortage2

Shortread3

Shouldibuy1

Shouldisell1

Shouldyoubuy1

Shouldyoulet1

Sizematters1

Smallbusiness1

Smart1

Snowman1

Socailhousing1

Social1

Sofew1

Solar1

Sold4

Solicitors2

Somethingsmaller1

South East Stats1

Southeast1

Spain1

Spare Room1

Specialhome1

Sponsorship1

Sports1

Spring3

Springsoom1

Springtime1

Stampduty3

Starts2

Stateofmarket1

Statisics2

Statistics30

Stats80

Staycation2

Staypositive1

Strategy1

Stress10

Ststs1

Success1

Summer2

Sunday1

Superb1

Support3

Survey2

Switchagents1

Takealoadoff1

Tax7

Tdc1

Tds2

Tea1

Tea Break1

Tea Time1

Teabreak6

Team1

Teatime2

Teatimeread1

Tech3

Teens1

Tenancy5

Tenant29

Tenants14

Tenure1

Terms1

Terrace1

Tesla1

Tgreen1

Thametproperty1

Thanet67

Thanetdistrictcouncil1

Thanetexperts2

Thanetheat1

Thanethomes1

Thanetlettings1

Thanetontheup1

Thanetprices1

Thanetpropertymarket1

Thanetsales1

Thankyou1

Thefuture1

Themarket1

Theplanet1

Things To Avoid1

Thoughtful1

Three Bedroom Homes1

Time2

Timescale1

Timetaken1

Timetomove1

Timetosell1

Tips25

Too Much1

Toptips1

Tory1

Tour1

Tradesman1

Traditions1

Trend1

Trends13

Trust4

Trustus1

Tthanet1

Tv1

Two Bedroom1

Uk3

Uk Property Experts1

UK Property Management1

Ukhousemarket3

Ukhousingtrends1

Uktrends1

Unfurnished1

Unique1

Usecookeandco1

Usp1

Uturn1

Valentine1

Valuation6

Value2

Vandor0

Vendor72

Viewing1

Viewings1

Viewnow1

Voids1

Wabi-Sabi1

Walking1

Websites1

Wecanhelp1

Weekend3

Welovetogetinvolved1

Wfh1

Whatisasurvey1

Whatitmeans3

Whats Next1

Whatshappening1

Whattolookfor1

Why1

Whycookeandco1

Whysolong1

Whyuseus2

Windowbox1

Windows1

Winter1

Winteriscoming1

Women2

Working1

Worldcomaprison1

Worldliteracyday1

Worldsmileday1

Worldview1

Worries1

XMAS10

Yields1

Young1

Youragent1

Tags

#2

#202213

#Buying1

#Landlord3

#Nationalgardeningweek1

#Nationalgardeningweekj0

#Property2

#Tenant2

10 Years1

103Days1

11Th Hour1

19521

19791

1Bed1

1In61

20204

202042

2021148

2022180

2023218

2023Easter1

2024135

20256

20301

20501

241

24 Hours1

30Yearletting1

4Bedroom1

50Hawleysquare1

5Tips1

6Step1

6Yearsold1

6Yr1

7 Days1

7Tips1

9Nterest Rate1

Abroad1

Accident1

Accidents1

Accountant1

Addvalue1

Adult1

Advantages1

Advice181

Aerialtour1

Afterchristmas1

Again1

Ageing1

Agent1

Agentvalue1

Agreement1

Ai1

Airbnb1

Album1

Animals1

Annual1

Annualreport1

Antibullingweek1

Apartment2

April8

April1st1

April20241

April241

Aprilfool3

Arla6

Arrears2

Article3

Articles1

August4

Autumn13

Average3

Averageage1

Averagehouseprice1

Averageprices1

Avergageprice1

Avergagethanet1

Award1

Babyboomer1

Babyboomers1

Back1

Backtoschool1

Badagent1

Badcredit1

Badpractive1

Bank Of England1

Bankofengland3

Bargain1

Bedroom1

Bedrooms1

Bedroomtrends1

Bees1

Best1

Bestpractice2

Billsincluded1

Birds1

Bitcoin1

Blog2

Blue Monday1

Blues1

Blunders1

Books1

Boom1

Boomers1

Breakingnews1

Brexit5

Broadstairs15

Btl6

Budget10

Bugs1

Builders1

Building1

Bully1

Bungalow3

Buster1

Buy4

Buy To Let1

Buyer8

Buyers4

Buying34

Buying Process2

Buyingandselling1

Buytolet15

Buytoletthanet1

Buytoley1

Buytorent2

Calm1

Camping2

Capital Gains4

Carbon Monoxide1

Care1

Carehomes1

Cash1

Cashbuyer1

Cats1

Celebrate0

Celebraties1

Celebration2

Census1

Chain1

Challenges1

Change1

Change Agent0

Change Estate Agent0

Changeagents1

Changeestateagents1

Changes1

Charging1

Charity6

Charm1

Checklist2

Child1

Children2

Chocolate3

Choosing1

Christmas24

Christmas Opening Hours1

Christmassong1

Cleaning7

Clientmoneyprotection0

Closed1

Comingsoon1

Commentry2

Community21

Communoy1

Communuity1

Compare1

Comparison1

Compliance1

Condensation2

Condition1

Confused1

Congratualtions1

Conservative2

Contractors1

Conveyancing3

Cooke & Co9

Cookeandco6

Cookeco2

Cooking1

Cop1

Cost2

Costly1

Costofliving7

Costs1

Councilhouse1

Couple1

Couples1

Covid1

Covid 198

Covid191

Crash3

Crask1

Crime1

Crooks1

Crystal Ball1

Crystalball1

Cuckooing1

Customerservice17

Cut2

Dads1

Damage1

Danger1

Debt1

December4

Declutter1

Decor1

Decorate1

Decorating1

Decore3

Dementia1

Deposits2

Depression1

Design5

Detached2

Detailed1

Developer3

Development3

Differences1

Digital1

Disaster1

Divorce4

Diy8

Dogs5

Dontmissout1

Dontpanic1

Dovorece1

Downsize1

Downsizing2

Dss1

Easter1

Education2

Election2

Electriccars1

Electricity2

Eliots Close1

Emergency2

Emotional1

Empireoflight1

Empty1

Emptyproperty1

Energey1

Energy10

Energycrisis3

Energysaving2

Enviroment1

Epc7

Equity1

Esater1

Estateagency1

Estateagent3

Estateagents1

Ethical1

Eu1

Euro2

Eurovision1

Eviction1

Exciting2

Exclusiveproperty1

Exercise1

Expereinced Agent1

Experience2

Expert1

Experts1

Fairytale1

Fallthrough1

Fallthroughs1

Families1

Family3

Fashion1

Fatherday1

Fathersday1

Fear1

Fengshui1

Festivals1

Festive1

Ffun1

Figures1

Films1

Finace1

Finacial Service1

Finacialadvice2

Finance4

Findnewhome1

Fireworks2

First Time Buyer3

First Time Buyers1

Firsthome1

Firsttime1

Firsttimebuy1

Firsttimebuyer12

Firsttimerenter1

Firttimebuyer1

Fivesenses1

Fivestars1

Fivestarservice1

Flat1

Foodbank1

Foodwasteweek1

Football2

Forecast1

Forsale8

Fraud4

Freehold1

Freshstart1

Friends2

Fs1

Ftb9

Fullreport1

Fun46

Fun Advice2

Future4

Gadgets2

Gains1

Games1

Garage1

Garden11

Gardens2

Gas1

Gen1

General12

General Election1

Generation2

Genz1

Getmoving2

Gifts2

Glastonbury1

Globalmortgage1

Gloomandoom1

Good Agent1

Good Ideal1

Good News1

Goodagent2

Goodestateagent2

Goodnews1

Goodpractice1

Goodtimes1

Google1

Govenment2

Government2

Granny1

Graph1

Greatagents1

Green4

Greetings1

Groundfloor1

Growyourown1

Guarentor1

Guide1

Hacks1

Hainelodge1

Halloween4

Handytips2

Happy0

Happy New Year1

Happyeaster2

Happyfathersday1

Happynewyear3

Health1

Heartfoundation1

Heatmap10

Heatmaps4

Help11

Helpbuying1

Helpselling1

Helptobuy1

Helptosell1

Hiddenspace1

Highervalue1

Hints2

Historicprices3

History3

Hmo1

Hmrc1

Hobby1

Hoiliday1

Holiday1

Holidayrent1

Holidays1

Holidayseason1

Home5

Homebuyer1

Homehacks1

Homeimprovements1

Homeinsurance1

Homeowner12

Homeownership3

Homes2

Homestaging1

Homesunderythehammer1

Honest1

Hot1

House Market3

House Prices29

Househunt1

Houseing1

Housemarket9

Houseplants1

Houseprice16

Houseprices9

Houses1

Houseshare1

Housing1

Housing Crisis1

Housing Market1

Housingcrisis2

Housingladder1

Housingmarket5

How Long1

How Long To Sell1

Hunt1

Ice1

Icerink1

Ideas6

Iinflation1

Imortgage1

Improvements2

Includebills1

Increasevalue2

Inetrnationalwomensday1

Inflation11

Information1

Inheritance5

Inpection1

Insight1

Insights1

Inspections1

Inspiration1

Instagram1

Insulation1

Insurance2

Interest11

Interesting2

Interestrate1

Interestrates2

Interiordesign1

Internet1

Inventory1

Investing1

Investment16

Investment Buy To Let1

Investments1

Investor1

Investors1

Itcominghome1

January1

Jargon1

Jeremyhunt1

Jeremyhuny1

Jobs2

Jointtenants1

Journeys1

Joy1

Joys2

July4

Jumpers1

June3

June241

Kids3

Kindness2

Kingcharles1

Kitchen2

Km1

Labour1

Land1

Landl;Ord1

Landlord148

Landlordchecklist1

Landlords16

Lanlord1

Lanlords0

Lastthree1

Law2

Laywer1

Ldecember1

Leadership1

Leasehold1

Legal1

Legislation20

Legit1

Letting19

Lettings10

Lettingwithfriends1

Lifetime Deposit1

Light2

Lights1

Limited1

Lioness1

Lletting1

Local5

Localauthority1

Loft1

London1

Long Article Stats1

Lonley1

Lookahead1

Lookfor1

Love3

Loves1

Luxury1

Lvendor1

Maintain1

Maintainance3

Makingtaxdigital1

Management8

Marathon1

March2

Margate22

Market15

Market Insight1

Marketcommentry9

Marketing3

Markets1

Mature1

May8

Mentalhealth12

Message1

Mistake1

Mistakes2

Modern1

Moneysaving1

Monthly1

Monthonmoth1

Morespace1

Morgage1

Mortgage15

Mortgagerates1

Mortgages1

Mortgate1

Mortgaterate1

Morthgage Freedom1

Mot1

Mother1

Mothers1

Mothersday2

Mould1

Movein1

Moving6

Mulitigenerational2

Mums1

Music2

Myths3

Naea2

National Average1

Nationalteaday1

Naturallight1

Negative1

New Build1

Newbuild4

Newdevelopment2

Newhome2

Newhomes2

Newnormal4

News1

Nightmare1

No Section 211

No Services1

Notice1

Nov241

November7

November 241

November242

November5th1

Novemver1

Numbersold1

Oap1

Obligations1

October10

Offer1

Oldertenants1

Oldtownmews1

Olympics1

Ombudsman1

Onebedroom1

Online1

Opening Times1

Optimistic1

Over501

Overcrowding1

Overpayment1

Overpricing1

Overvalue1

Overvaluing3

Pandemic1

Paperwork1

Parenting1

Parents2

Partner1

Personal1

Pests1

Pets9

Photographs1

Photography1

Pitfalls2

Planning3

Plants1

Plastic2

Poem1

Politics2

Pollen1

Poltics1

Poppy Day1

Popular1

Portals1

Portfolio1

Posh1

Ppsqft1

Predictions1

Price1

Price Smart1

Pricedrop1

Pricerise1

Prices3

Pricing1

Private2

Privatelandlord1

Privatesale1

Probate2

Problems3

Process1

Professional1

Profit1

Progression2

Properttymarket1

Property21

Property Coownership1

Property Market2

Propertyexperts1

Propertyinsights1

Propertyinvestmentinsights1

Propertyinvestmenttips1

Propertymarket20

Propertyprice1

Propertyprices4

Propertystats3

Propertysurge1

Propertyupdate2

Purchase1

Purchaser2

Quarter 21

Quarter One1

Quatar1

Questions2

Quickread1

Quiz1

Ramance1

Ramsgate24

Rate1

Rates3

Reading1

Readytomove1

Readytosell1

Recession1

Recommended1

Recycle1

Redflags1

Reduce1

Reduction1

Reductions3

Referb1

Reference1

References1

Refubishment1

Regret0

Relax1

Relocation1

Rememberance2

Remorse1

Rent2

Rental8

Rented6

Renter Right1

Renters Act1

Renters Reform1

Rentersreform1

Renting5

Rentorsell1

Rents18

Reolutions1

Repairs10

Reports1

Repurposing1

Research1

Reservations1

Resolutions1

Retail1

Reterreform1

Retire1

Retirement1

Return1

Review2

Reviews1

Rics1

Rightmove1

Rights1

Righttime1

Rise1

Rises2

Robbery1

Robottakeover1

Royal British Legion1

Sad1

Sadness1

Safety2

Sales10

Salesupdate1

Save1

Savetheplanet2

Savethousands1

Scams2

School1

Schools1

Scrabble1

Seaside1

Seasons1

Secondtimearound1

Secret Tips1

Secrets2

Section211

Section81

Security3

Selfbuild1

Selfmanage1

Sell1

Sellafterbuy1

Sellbeforebuy1

Seller15

Sellhomefaster1

Selling106

Selling Process4

Selling Tips1

Sellingblunders1

Sellingmyhomne1

Sellingtips1

Selliptips1

Selloff1

Semidetached1

September7

Shoplocal2

Shopping1

Short6

Shortage1

Shortread3

Shouldisell1

Showdown1

Sixbuyertypes1

Sixtips1

Sizematters1

Smallbusiness1

Smart1

Socailhousing1

Socails1

Social1

Social Media1

Sold4

Solicitor1

Solicitors2

Southeast2

Spacious1

Spain1

Special1

Spingclean1

Spratlingland1

Spring16

Sq Ft1

Sqft3

Squirrels1

Staging1

Stamp Duty2

Stampduty1

Starmer1

Starts1

Statisics1

Statistic1

Statrs1

Stats56

Staycation2

Stayin1

Storage1

Stress7

Stressreduction1

Stressrelief1

Style1

Styles1

Summer3

Summerscoming1

Sun1

Sunday1

Supply1

Support2

Suprise1

Surge1

Surveys1

Switch1

Tax6

Taxcuts1

Tea Time Read1

Teabreak12

Teabreakread1

Team1

Teatime7

Tech4

Teen1

Teenmoving1

Tenancies1

Tenancy2

Tenant26

Tenant Abandonment1

Tenants10

Tenats1

Tenure1

Terms1

Terraced3

Thanet82

Thanet Homes1

Thanet Property Market1

Thanetlandlords1

Thanetoctober1

Thanetproperty1

Thankyou1

Thatcher1

Themarket1

Threebeds1

Tiktok1

Time1

Timetosell2

Tip1

Tips16

Too Many1

Top31

Torent1

Tory2

Tradesman1

Trands1

Trends8

Tricks1

Tthoughts1

Tufty1

Tunes1

Tv2

Uk2

Uk Property1

Ukhousemarket1

Ukhousing2

Ukproperty1

Ukrealestatetrends1

Unscrupulous1

Unusual1

Update1

Usecookeandco0

Valentine1

Valentines1

Valuation6

Value1

Valuing1

Vegetables1

Vendor48

Vermin1

Vicki1

Viewings2

Voids1

Wabi-Sabi1

Waitinglist1

Waling1

Warning0

Waste1

Wecanhelp1

Wewillremeberthem1

Whatsbest1

Whatsthemarketdoing1

Whychooseus2

Wildlife1

Willitcrash2

Windowbox1

Windows1

Winter5

Women1

Work1

Workfromhome1

World2

Worldcup2

Worldmusicday1

Worldphotographyday1

Worldscrabbleday1

Worldsmileday1

Worry1

Xmas14

Xmaschecklist1

Yields1

Young1

Youtube1