With inflation and the cost-of-living crisis, some

say this could cause property values to drop by between 10% and 20% in the next

12 to 18 months.

There can be no doubt that the current Margate property market is very interesting.

At the time of writing, there are only 555 properties for sale in Margate (the long-term 15-year average is between 1,280 and 1,310), meaning house prices have gone up considerably.

According to the Land Registry …

Margate property prices have increased by 12.4% (or £32,800) in the last 12 months.

So, as Robert Kiyosaki says, ‘the best way to predict the future is to look to the past’. I need to look at what caused the last property crash in 2008 and how that compares to today.

Increase in Interest Rates

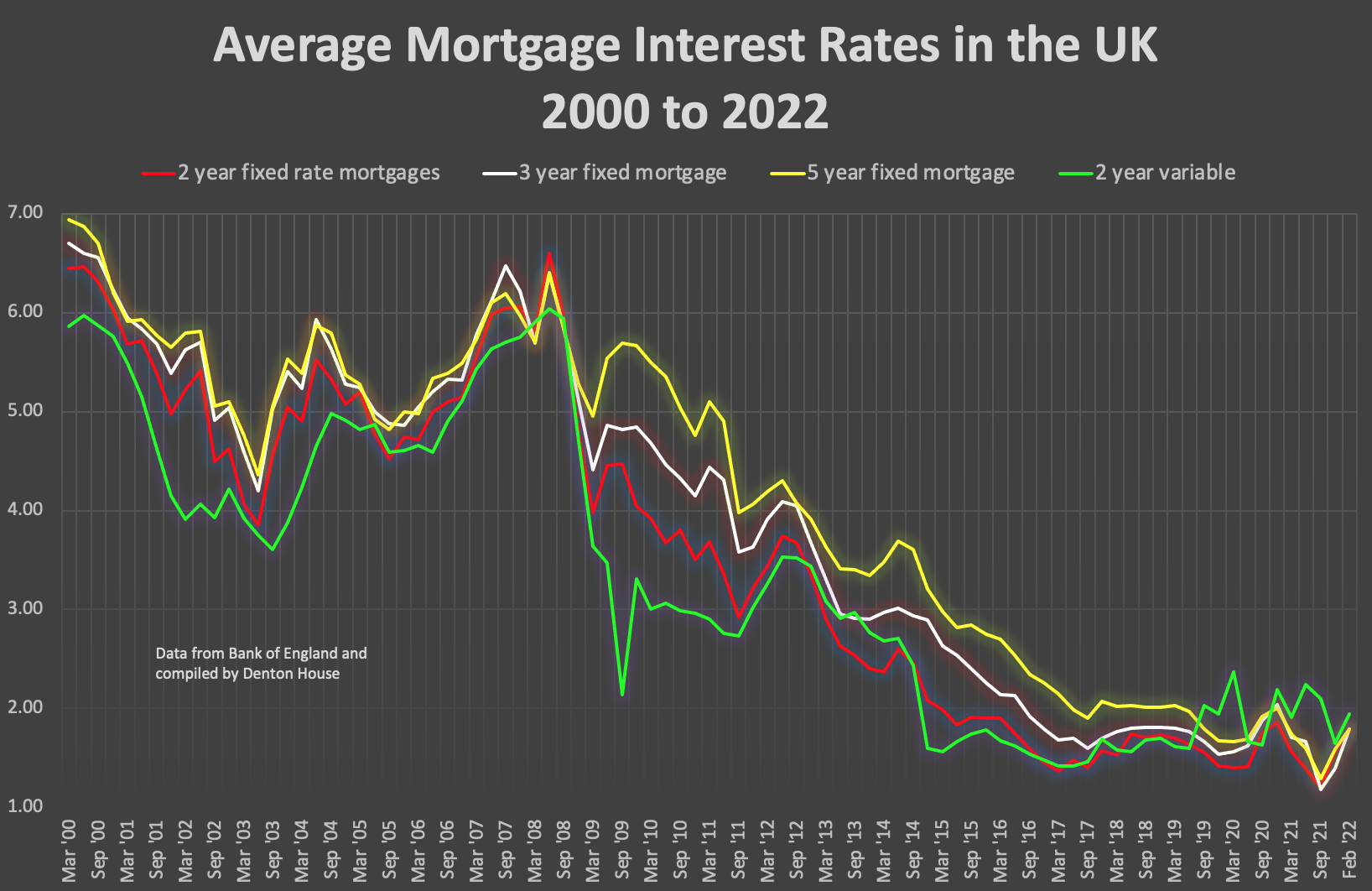

One reason mentioned as a possible cause of a crash is the rise in the Bank of England interest rates, affecting homeowners' mortgages.

Higher mortgage rates mean homeowners will have to pay a lot more on their mortgage payments, leaving less for other household essentials. In 2007 (and the 1989 property crash), many Margate people put their houses up for sale to downsize to try and reduce their mortgage payments.

Yet the newspapers fail to mention that 79% of British people with a mortgage have it on a fixed interest rate

(at an average mortgage rate of 2.03%).

Also, just under 19 out of 20 (93.2%) of all UK

house purchases in 2021 fixed their mortgage rate.

So, in the short to medium-term (two to five

years), most homeowners won't see a rise in mortgage payments for many years.

Also, 27.8% of all UK house purchases were 100% cash (i.e. no mortgage).

Of the 932,577 house purchases registered since February 2021

in the UK, 259,205 were bought without a mortgage.

Yet some people say this will

be a problem when all these homeowners come off their fixed rate. The mortgage

lending rules changed in 2014, and every person taking out a mortgage would

have been assessed at application as to whether they could afford their

mortgage payments at mortgage rates of 5% to 6% rates, not the 2% to 3% they

may well be paying now.

No pundit says the Bank of England interest rates will go above 2% with a worst-case scenario of 3%. If the Bank of England did raise interest rates to 3%, homeowners would only be paying 4.5% to 5.5% on their mortgages and thus well within the stress test range made at the time of their mortgage application.

This means the probability of a mass sell-off of Margate properties or Margate repossessions because of interest rate rises (both of which cause house prices to drop) is much lower.

House Price/Salary Ratio

Another reason being bandied about by some people

for another house price crash is the ratio of average house prices compared to

average wages.

The higher the ratio, the less affordable property is. In 2000, the UK average house price to average salary ratio was 5.30 (i.e. the average UK house was 5.3 times more than the average UK salary). At its peak just before the last property crash in 2008, the ratio reached 8.64.

The ratio now is 8.85, so some commentators are beginning to think we’re in line for another house price crash. However, I must disagree with them because mortgage rates are much lower today than in 2007. For example …

The average 5-year fixed-rate mortgage in 2007 was 6.19%

(just before the property crash), yet today it’s only 1.79%.

So, whilst the house price/salary ratio is the same as the last property crash in 2008, mortgages today are proportionally 71.1% cheaper.

Banks Reckless Lending

Another

reason for a property crash in 2008 was the reckless lending practices in the

run-up to that crash.

The first example of reckless lending was self-certified mortgages. A self-certified mortgage is when the lender doesn’t require proof of income.

In 2007, 24.6% of new mortgages were self-certified mortgages.

So, when the economy got a little sticky in 2008, the people that didn’t have the income they said they had to pay for their mortgages (because they were self-certified) promptly put their properties on the market.

The banks' second aspect of reckless lending was how much they lent buyers to buy their homes. Today, banks want first-time buyers to have at least a 10% deposit and ideally more. There are 95% mortgages available now (meaning the first-time buyer only requires a 5% deposit), yet they are pretty challenging to obtain.

Back in 2005/6/7, Northern Rock was allowing first-time buyers to borrow 125% of the value of their home. Yes, first-time buyers got 25% cashback on their mortgage!

In 2007,

9.5% of all mortgages were 95%, and 6.1% of mortgages were 100% to 125%.

Meaning that nearly 1 in 6 mortgages (15.6%) taken out in 2007

had a 95% to 125% mortgage.

When the value of a property goes below what is owed on the mortgage, this is called negative equity. A lot of Margate homeowners with negative equity (or who were getting close to negative equity) in 2008 panicked because of the Credit Crunch and put their houses up for sale.

To give you an idea of what happened last year (2021) regarding mortgage lending, only 2.4% of mortgages were 95%, and 0.2% of mortgages were 100%. This is because the mortgage lending rules were tightened in 2014.

So why did Margate house prices drop in 2008?

Well, in a nutshell, a lot more Margate properties came onto the market at the same time in 2008, flooding the Margate property market with properties to sell.

Meanwhile, mortgages became a lot harder to obtain (because it was the Credit Crunch), so we had reduced demand for Margate property.

Prices drop when we have an oversupply and reduced demand for something. Margate property prices fell by between 16% and 19% (depending on the property type) between January 2008 and May 2008.

So, what were the numbers of properties for sale in Margate during the last housing market crash?

There were 1,710 properties for sale on the market in Margate in the summer of 2007 (just before the crash), whilst a year later, when the Credit Crunch hit, that had jumped to 2,350.

This vast jump in supply and the reduction in demand caused Margate house prices to drop in 2008.

Compared with today, there are only 555 properties for sale in Margate, whilst the long-term 15-year average is between 1,280 and 1,310 properties for sale.

So, what is going to happen to the Margate property market?

The Margate house price explosion since we came out of Lockdown 1 has been caused by a shortage of Margate homes for sale (as mentioned above) and increased demand from buyers (the opposite of 2008).

However, there are early signs the discrepancy of supply and demand for Margate

properties is starting to ease, yet this takes a while before it has any effect

on the property market, so it will be some time before it takes effect.

This will mean buyer demand will ease off whilst the number of

properties to buy (i.e. supply) increases. This should gradually bring the Margate

property market back in line with long-term levels, rather than the housing

market crash.

My advice is to keep an eye on the number of properties for sale in Margate

at any one time and only start to worry if it goes beyond the long-term average

mentioned above.

But before I go, I need to chat about what inflation and the cost of

living will do to the Margate property market.

How will inflation and cost of living affect the

Margate Property Market?

There is no doubt that cost-of-living increases will have a dampening effect on buyer demand. If people have less money, they won’t be able to afford such high mortgages. This will slow Margate house price growth, especially with Margate first-time buyers.

Yet, the reduction in first-time buyers is being balanced out by an increase in buy-to-let landlord's buying, especially at the lower end of the market.

This, in turn, will stabilise the middle to upper Margate property

market. This means the values of such properties (mainly Margate

owner-occupiers) will see greater stability and a buyer for their home, should

they wish to take the next step on the property ladder.

So why are more Margate landlords looking to extend their

buy-to-let portfolios, even in these economic circumstances?

I see new and existing buy-to-let Margate landlords come back into the

market to add rental properties to their portfolios. As the competition with

first-time buyers is not so great, they’re not being outbid as much.

Yet, more importantly, residential property is a good hedge against

inflation.

Firstly, in the medium term, property values tend to keep up with

inflation.

Secondly, inflation benefits both landlords and existing homeowners,

with the effect of inflation on mortgage debt. As Margate house prices rise

over time, it reduces the loan to value percentage of your mortgage debt and

increases your equity. When the landlord/homeowner comes to re-mortgage in the

future, they will receive a lower interest rate.

Thirdly, as the equity in your Margate property increases, your

fixed-rate mortgage payments stay the same.

Finally, inflation also helps Margate buy-to-let landlords. This is

because rents tend to increase with inflation. So as rents go up, your fixed-rate

buy-to-let mortgage payments stay the same, creating the prospect of more

significant profit from your buy-to-let investment.

No comments

Leave a comment