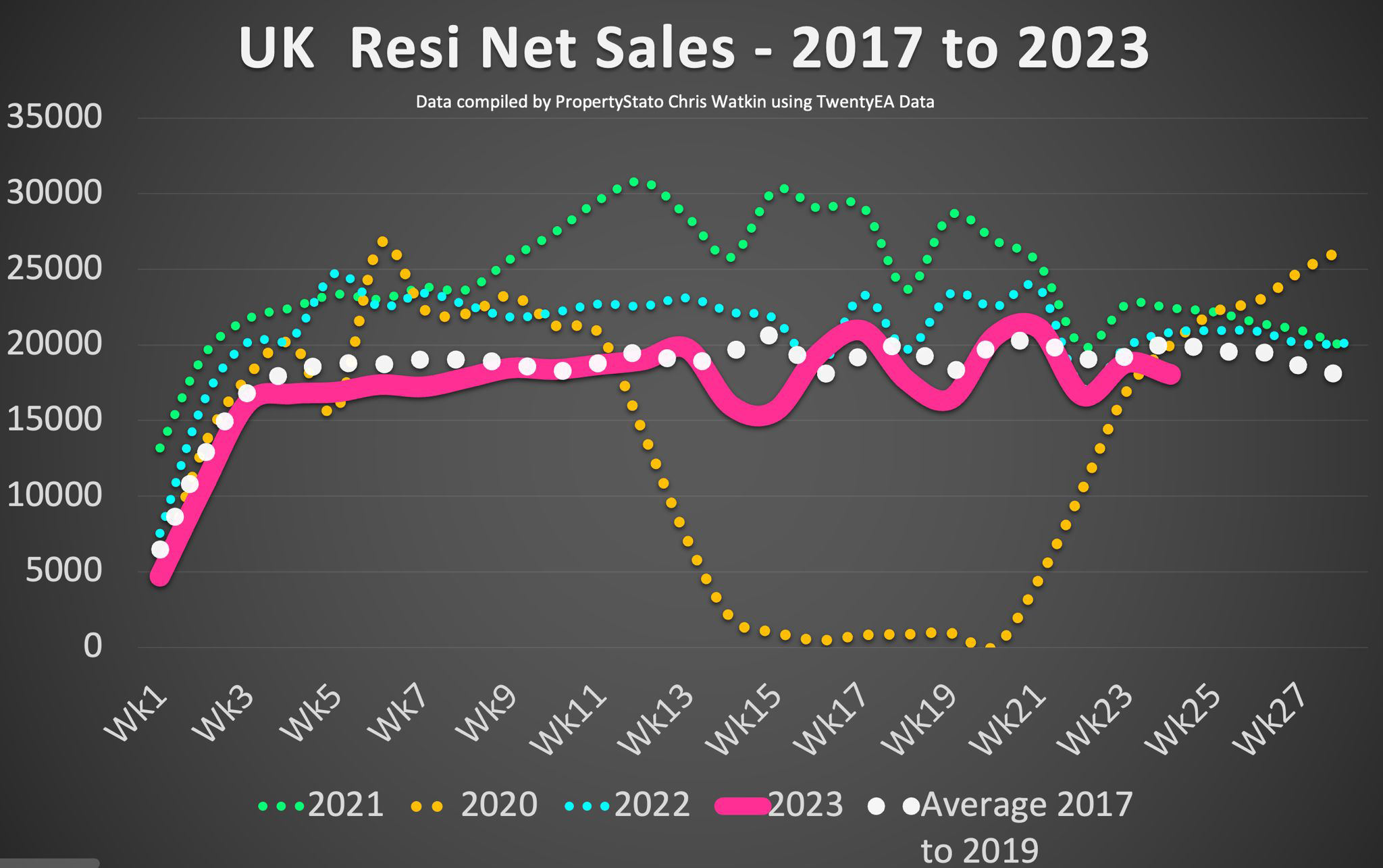

Despite what you may hear in the media, the UK property market remains remarkably buoyant, as latest figures provided by industry titans, Christopher Watkin and Bryan Mansell, clearly indicate (Figures correct when article released). The numbers suggest an encouraging trend, particularly with properties marked as "Sale Agreed" last week standing 5.9% higher than the weekly average for 2023 - a definite silver lining amidst ongoing economic challenges.

When we consider regional trends in house sales, some areas like the South East are performing notably well, outpacing their 2023 weekly average by 7.6%. However, as 30 year estate agency veteran and Thanet expert Damien Cooke cautions, it's vital to keep our optimism in check, especially with the recent rise in interest rates. He notes the importance of estate agents being realistic when valuing properties, warning against the temptation to inflate prices, only to have properties stagnate on the market.

Damien's warning rings particularly true for areas such as Thanet, where some agents are observed to disregard recent comparable sales, and instead quote prices exceeding the expected market appraisal by over £30,000. This, combined with long-term sole agency contracts followed by subsequent price reductions, only serves to disrupt the market and dampen consumer trust.

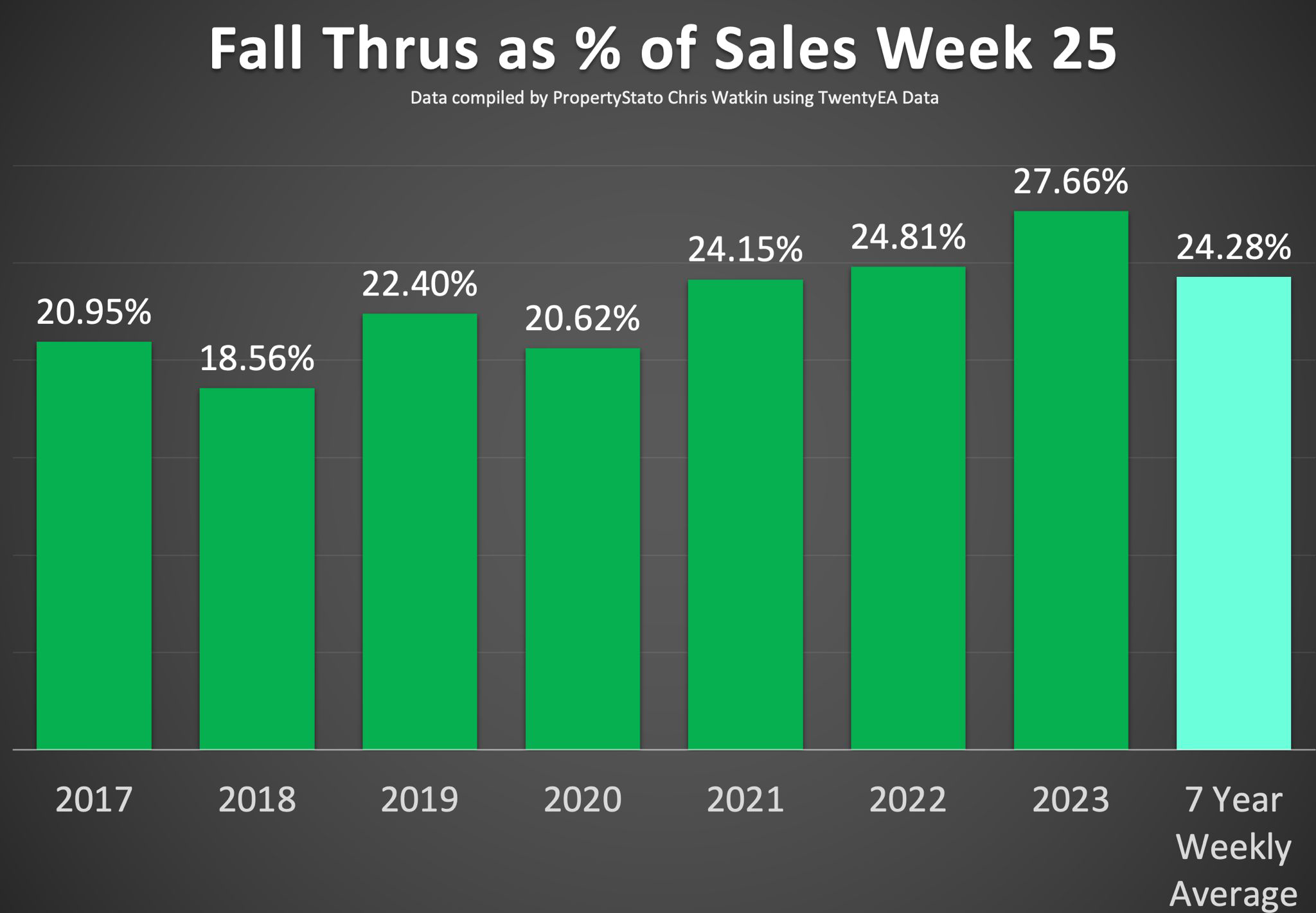

An upward trend in Sale Fall Thru rates is also worth noting. The current weekly rate stands at 27.66%, crossing the 25% threshold for the second consecutive week. Though this rate is lower than Q4 2022's average of 38.7% per week, it still deserves close attention.

Damien highlights the critical role of estate agents in steering clients towards reliable solicitors and conveyancers, as opposed to those merely offering the highest referral fees. An experienced sales progressor and a trustworthy team are also vital for effective communication and transparency in the sales process, often making the difference between a successful sale and a fall through.

Delving into last week's property market Key Performance Indicators and statistics, we see some interesting figures. New property listings for the week totaled 36,114, significantly outpacing the 2023 weekly average of 32,788. Similarly, the average listing price came in at £449,739, comfortably exceeding the 2023 weekly average of £433,986.

Price reductions for the week stood at 23,573, again higher than the 2023 weekly average of 18,589. Moreover, the average asking price for reduced properties was £435,232, markedly higher than the £405,463 average for 2023.

Another heartening statistic is the number of properties sold - a gross sale of 23,668 properties. This figure surpasses the 2023 weekly average of 22,345. The average asking price for those properties that Sold STC was also higher at £371,014, compared to the 2023 weekly average of £359,321.

Despite a rise in sale fall-throughs to 6,546, compared to the 2023 weekly average of 5,139, the UK property market's resilience shines through. Notably, the Sale Fall Thru Rate, calculated as a percentage of gross sales for the week, stood at 27.66% - below the peak seen in 2022.

In conclusion, while fluctuations in the UK property market are to be expected, the recent data analysed by Christopher Watkin, Bryan Mansell and Damien Cooke paints a picture of a robust and enduring market.